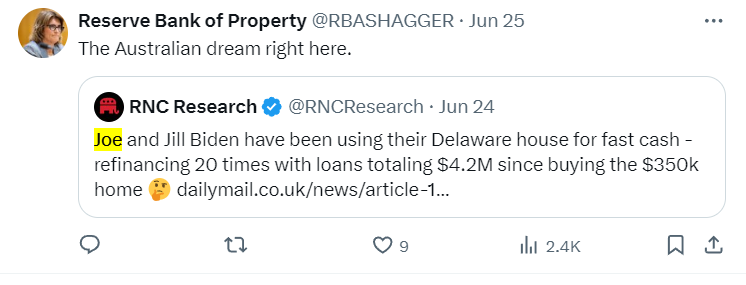

United States President Joe Biden and First Lady Jill Biden have reportedly leveraged their Delaware real estate holdings extensively over the years, transforming them into a significant financial resource. A detailed report by the Daily Mail reveals that Joe Biden has treated his Delaware properties as a “personal ATM,” engaging in frequent refinancing and borrowing activities that have accumulated to substantial sums.

Extensive Borrowing History

Between 1978 and 1994, Joe Biden and Jill Biden sanctioned 13 home loans and two credit agreements totaling $1.72 million. This period marks the beginning of a pattern where Joe Biden negotiated new mortgage or credit deals approximately every 17 months. The frequent refinancing has puzzled financial experts, with one commenting, “It doesn’t make a lot of sense unless they were desperate for cash.”

Joe Biden’s Delaware Mansion Mortgage History

Joe Biden’s current residence, a mansion in Delaware purchased in 1996 for $350,000, has been central to his borrowing strategy. Despite the initial modest purchase price, Joe Biden’s Delaware mansion mortgage history reveals extensive leveraging. The property has been leveraged through 20 different home credit agreements and mortgages totaling $4.23 million. Nearly three decades later, the Delaware home still has an outstanding mortgage of $541,000.

LA realtor Tony Mariotti expressed surprise at this strategy, stating, “Why would anyone view their home as an ATM? Over time, mortgage fees really add up. Paying off a mortgage is like a forced savings account that bears modest interest.” Joe Biden’s Delaware mansion mortgage history indicates a significant financial maneuvering to maintain liquidity and address financial needs.

The Rehoboth Beach Property

In addition to their primary Delaware residence, Joe Biden and Jill Biden own a summer home in Rehoboth Beach, Delaware, which was purchased in 2017 for $2.74 million in cash. This property, unlike their other Delaware holdings, has no mortgages attached. However, financial records indicate that Joe Biden has significant debt, including a mortgage and an equity loan on his Wilmington, Delaware home.

Biden Family’s Liability and Asset Breakdown

A closer look at Joe Biden’s financial position reveals a significant level of debt and a notable array of assets. The family’s total liabilities range between $350,000 and $850,000. These liabilities include mortgages and equity loans, primarily tied to their Wilmington, Delaware home. Despite these debts, Joe Biden’s estimated assets fall between $1 million and $2.6 million. These assets encompass their Delaware real estate holdings, personal savings, and other investments.

Joe Biden’s reported net worth is around $10 million. The extensive refinancing and borrowing activities over the years have added a layer of complexity to his financial history. This strategic leveraging of his Delaware properties has allowed him to maintain liquidity and potentially finance various personal and professional expenses.

Expert Opinions

Financial experts have weighed in on Joe Biden’s borrowing practices. The frequent refinancing raises questions about the reasons behind such financial moves. Some experts speculate that Joe Biden might have been in need of cash for various personal or professional reasons. The strategy of using home equity to finance expenses is not uncommon, but the frequency and scale of Joe Biden’s actions are notable.

Scrutiny and Transparency

These revelations come at a time when Joe Biden’s financial transactions are under scrutiny. The transparency of political figures’ finances is crucial for maintaining public trust, and Joe Biden’s extensive borrowing history adds a layer of intrigue to his financial past. As President Joe Biden continues his term, the financial decisions made by him and the First Lady will likely remain a topic of interest and analysis.

Conclusion

Joe Biden’s use of his Delaware properties as a financial resource demonstrates a complex and strategic approach to managing his finances. While some may view the frequent refinancing as a savvy financial move, others see it as a sign of financial instability or desperation. Regardless, Joe Biden’s borrowing history offers a fascinating glimpse into the financial practices of the First Family, highlighting the intricate balance between asset management and debt accumulation. Joe Biden’s Delaware mansion mortgage history underscores the significant role that his Delaware real estate holdings have played in their overall financial strategy, reflecting a pattern of leveraging assets to manage financial obligations and maintain liquidity.

For further insights and comprehensive content, please visit our homepage